Executive Order on Ensuring Responsible Innovation in Digital Assets

On March 9, 2022, President Joe Biden signed an executive order (EO) to engage several federal agencies in a comprehensive review of the federal government’s approach to cryptocurrencies and digital assets. The broad scope of the EO outlines a unified, “whole-of government” approach to developing policy for digital assets across five key priorities: (1) potential introduction of a United States Central Bank Digital Currency (CBDC); (2) consumer, investor, and business protection; (3) financial stability and systemic risk; (4) illicit finance and national security; and (5) U.S. leadership in the global financial system and economic competitiveness. The EO also focuses on the impact that blockchain technology and digital assets can have on financial inclusion and human rights (including the unbanked and underbanked) as well as on climate change and environmental pollution (including energy usage from mining and grid management).

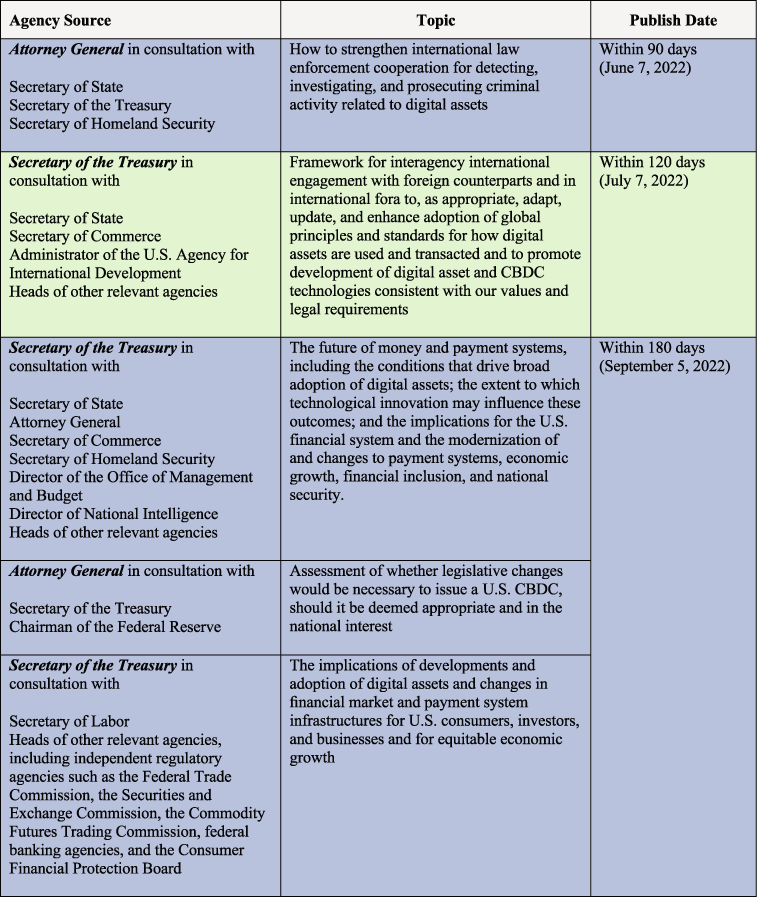

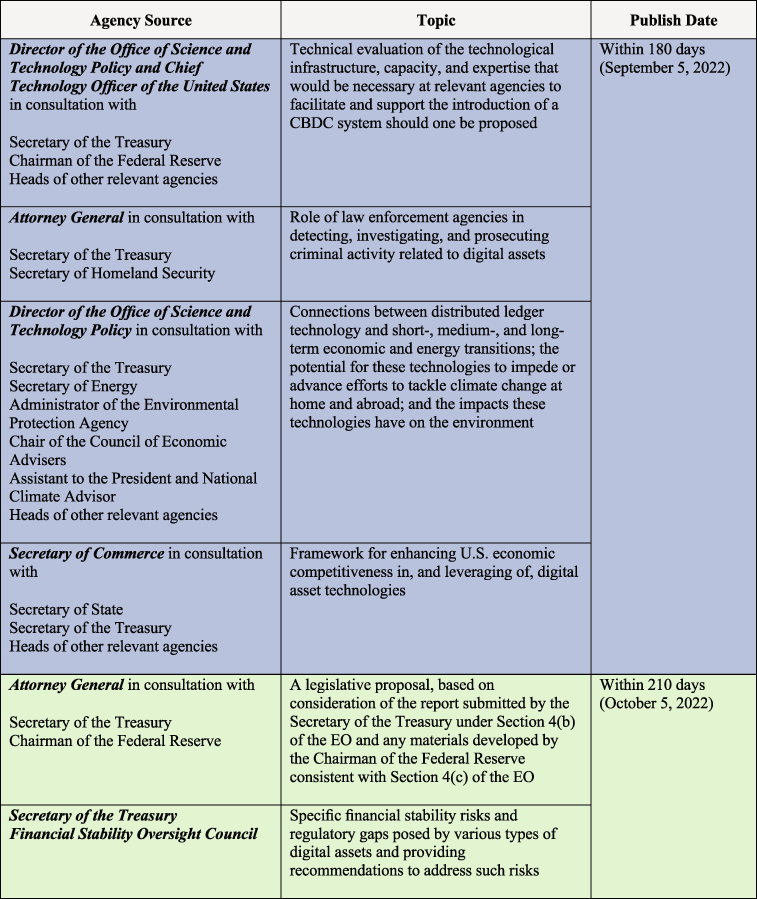

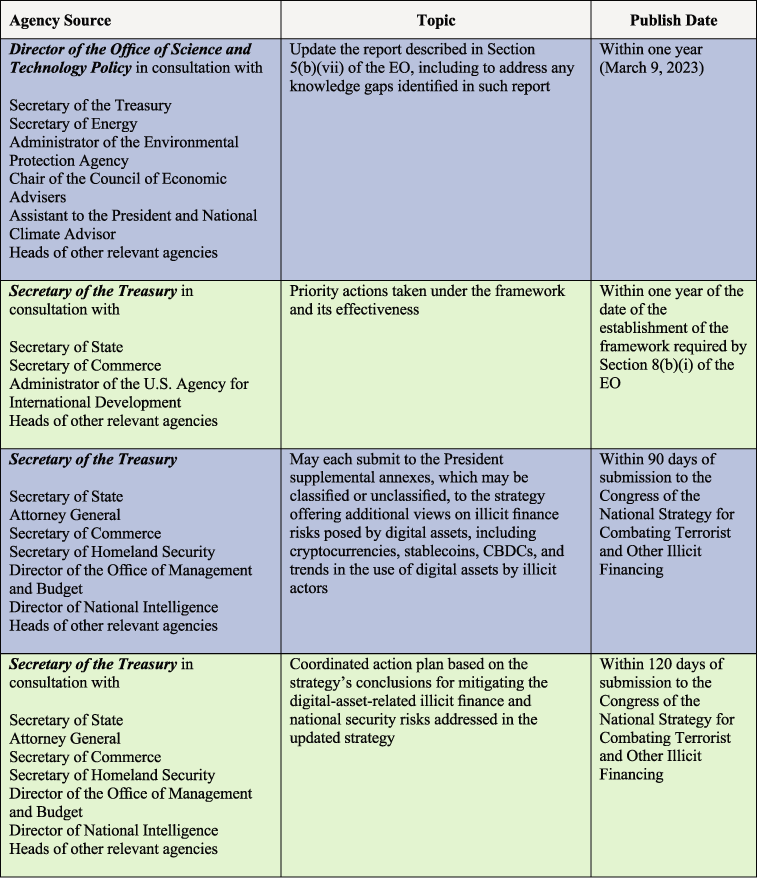

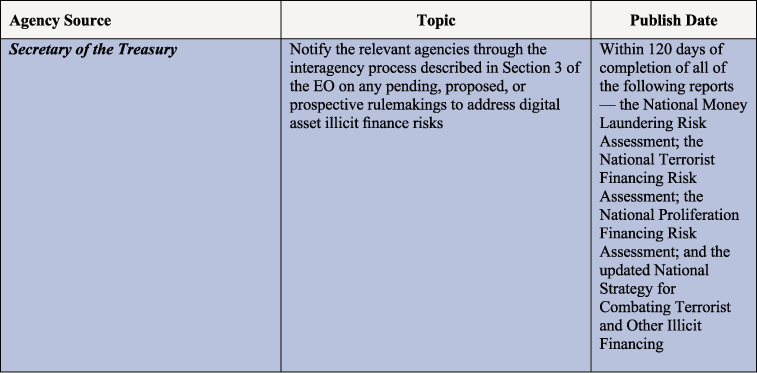

One of the administration’s principal motivations in issuing the EO is to gain sufficient background information, supporting data, and regulatory and legislative options to achieve the above-described policy objectives. The EO therefore requests reports, generally within 90 to 180 days, from a variety of federal agencies analyzing issues and implications related to digital assets and providing recommendations with respect to the five priorities.

Though the EO does not itself implement any policies, establish any regulations, or restrict any action in the cryptocurrency and digital asset space, it does appear to reflect the administration’s recognition of the increasing prevalence of this emerging technology and a desire to develop a regulatory regime applicable to the space’s unique architecture that addresses public policy considerations while promoting innovation.

As the administration solicits input from across the federal government over the next three to six months, we recommend that clients engage in affirmative outreach (directly and through trade associations) to applicable representatives and regulators to ensure that industry perspectives are considered as early as possible in the process and that any new regulations or legislative proposals are workable and practical in light of both the variations among digital asset use cases and the torrid pace of innovation in the industry. Although a number of federal agencies have been studying (and even implementing) blockchain and digital asset technology for some time, industry participants should not assume that the level of knowledge in all quarters is sufficient to fully assess the implications of policy initiatives that may be under consideration. In addition, the emphasis that the EO places on coordination across the government, including across both the economic and national security decision-making apparatus, suggests that even knowledgeable government actors may need to consider these technologies and their implications in new ways. Accordingly, early engagement and dialogue will be critical to help ensure that the shape of regulation is based on a foundation that is well informed.

This post is as of the posting date stated above. Sidley Austin LLP assumes no duty to update this post or post about any subsequent developments having a bearing on this post.